In a recent landmark case, Jacobus Bernhard Hulst vs. PR Builders, Inc., the Supreme Court provided valuable clarity regarding the acquisition of condominium and townhouse properties by foreign nationals in the Philippines. This clarification revolves around the provisions of RA 4726, more commonly known as The Condominium Act, which explicitly permits foreigners to purchase condominium units and shares in condominium corporations, subject to certain limitations.

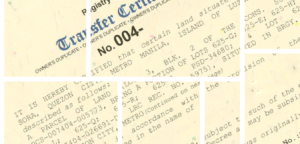

RA 4726 permits foreign nationals to own Philippine real estate through the acquisition of condominium units or townhouses structured under the Condominium principle, each having its Condominium Certificate of Title.

This unique ownership model separates the land from the individual units. The land itself is owned by a Condominium Corporation, while each unit owner becomes a member of this Condominium Corporation. As long as at least 60% of the Condominium Corporation’s members are Filipino citizens, the remaining membership may be composed of foreigners.

The key provision of interest is Section 5 of R.A. No. 4726, which reads as follows:

“Section 5. Any transfer or conveyance of a unit or an apartment, office or store or other space therein, shall include the transfer or conveyance of the undivided interest in the common areas or, in a proper case, the membership or shareholdings in the condominium corporation; Provided, however, That where the common areas in the condominium project are held by the owners of separate units as co-owners thereof, no condominium unit therein shall be conveyed or transferred to persons other than Filipino citizens or corporations at least 60% of the capital stock of which belong to Filipino citizens, except in cases of hereditary succession. Where the common areas in a condominium project are held by a corporation, no transfer or conveyance of a unit shall be valid if the concomitant transfer of the appurtenant membership or stockholding in the corporation will cause the alien interest in such corporation to exceed the limits imposed by existing laws.”

In a nutshell, for a foreign national to acquire a condominium or townhouse under the Condominium Act, the land on which the property stands must be owned by the Condominium Corporation. Therefore, any purchaser, including foreign nationals, are effectively members of the condominium corporation. This arrangement ensures compliance with the constitutional prohibition of foreign ownership of private lands in the Philippines.

For a foreign national interested in purchasing a condominium unit or townhouse with a Condominium Certificate, it is vital to confirm that the 40% limitation on foreign ownership within the Condominium Corporation is adhered to.

As an additional safety measure when buying a condominium unit, one may inspect the property’s standing status before the Human Settlements Regulatory Commission (HLURB), as outlined in Presidential Decree 957, which mandates that records of subdivision lots and condominium units are maintained and open for public inspection, subject to reasonable rules set forth by the Authority.

In essence, this legal framework allows foreign nationals to invest in condominiums and townhouses in the Philippines, provided they abide by the established guidelines, thereby ensuring the proper balance between foreign investment and the protection of national interests.