In the previous BLOG, we discussed the list of requirements needed for land/condominium title transfer. Now, we are going to discuss the process you need to go through to be able to transfer land/condominium titles from the previous owner (Seller) to the new owner (Buyer) of the property.

Before we discuss the process, it is important to know why is there a need to transfer land/condominium titles from the previous owner (Seller) to the new owner (Buyer) of the property.

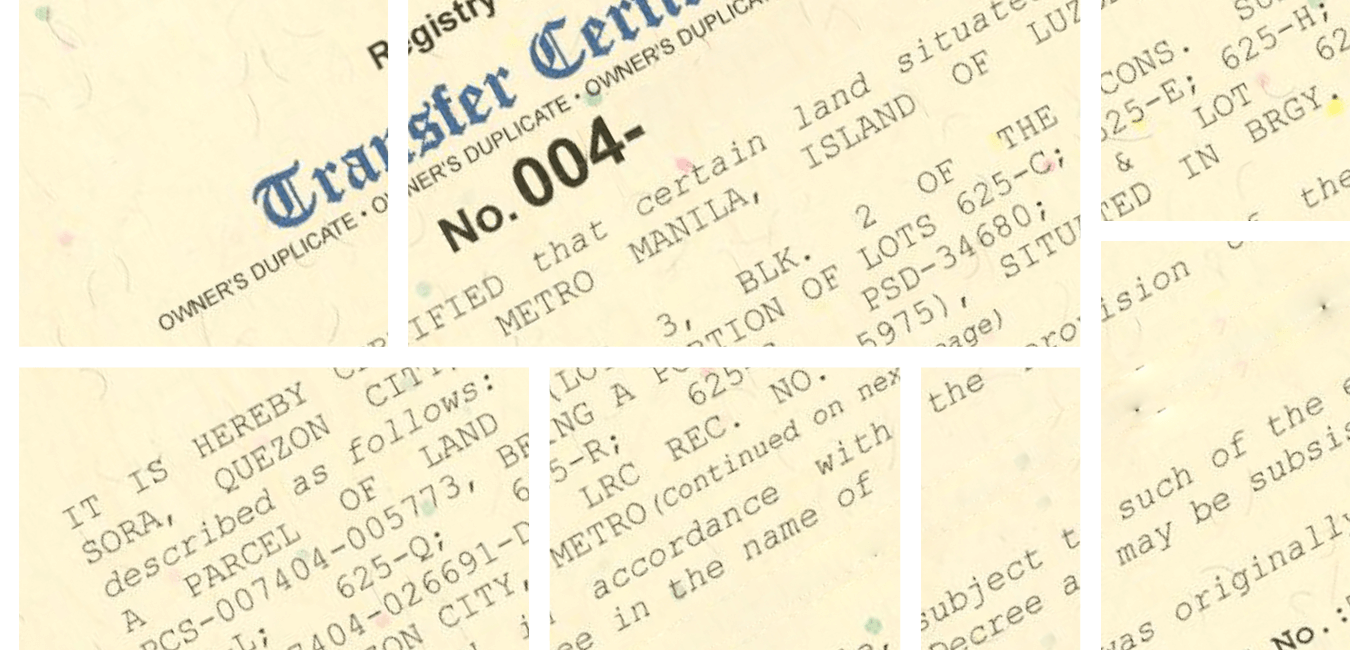

Certificate of title (whether original title or owner’s duplicate copy of title) is the best evidence of ownership for real property such as land or condominium. Being the best proof or evidence of ownership, you will be required to present or show a certificate of title in all transactions or dealings involving real property. For example, as owner, if you want to sell or mortgage the real property to the bank, you will be required by the latter to submit proof of ownership such as the certificate of title. If there will be other persons who will claim rights or ownership over your real property, the best evidence would be a certificate of title registered under your name.

So, how do you transfer land/condominium titles from the Seller to the Buyer (new owner)?

First, the parties must execute a deed of conveyance/transfer such as a Deed of Absolute Sale (DOAS). It must be stated in the DOAS that the seller has agreed to transfer the ownership of the subject real property in favor of the buyer who already paid the full amount of the purchase price. The DOAS must be duly notarized before a Notary Public.

After signing the DOAS and having it notarized before a Notary Public, the parties through their representatives must pay the corresponding taxes before the Bureau of Internal Revenue (BIR). You will be required to present before the BIR, the following: (a) the certified true copy of the title, (b) latest tax declaration and (c) original deed of absolute sale. After Assessment, the seller must pay the Capital Gain Tax (CGT) which six percent (6%) of the purchase price or zonal value of the property whichever is higher. Likewise, the parties must pay the Documentary Stamp Tax (DST) which is 1.5% of the purchase price or zonal value of the property whichever is higher. After paying the corresponding taxes, the BIR will issue a Certificate Authorizing Registration (CAR) of the subject property.

Aside from paying the CGT and DST, the buyer must also pay the transfer tax before the City or Municipality where the property is located. The transfer tax ranges from 0.0075% to 1% of the value of the real property. After paying the transfer tax, the City or Municipality shall issue an official receipt for payment of transfer tax and a tax clearance certificate.

The final step for the land/condominium title transfer will be at the Register of Deeds where the property is located, and the buyer (new owner) will be required to submit the original owner’s duplicate copy of title, original deed of sale, certified true copy of latest tax declaration and original copy of Certificate Authorizing Registration (CAR). Likewise, the new owner will be required to pay the corresponding registration fee for the issuance of new title his/her name.

P.S. In case you need assistance relative to land/condominium title transfer, you may visit DOMINIUM Land Title Service with office address at 625 Vinia Residences Philam, EDSA Southbound, Quezon City.