If a government infrastructure project is planned near you, understanding “Right-of-Way” (ROW) is crucial for protecting your property and ensuring fair treatment. This guide will help you navigate the process based on the rules and procedures set by the Department of Public Works and Highways (DPWH) in the Philippines.

What Exactly is Right-of-Way (ROW)?

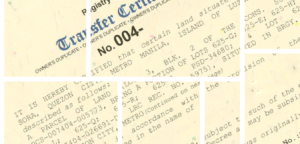

Right-of-Way (ROW) refers to a specific portion of land or property that is needed or used by a national government infrastructure project [24, 864f]. These projects are vital for the social and economic development of the Philippines. In the past, acquiring land for infrastructure projects was often a long and complicated process, which significantly delayed project implementation to the detriment of the public. Clear guidelines are now in place to achieve a more effective and expeditious implementation of these projects.

The Law that Protects You: The Right-of-Way Act (RA No. 10752)

The process for acquiring ROW is governed primarily by Republic Act No. 10752, also known as “The Right-of-Way Act”. This law, which became effective on April 3, 2016, and its Implementing Rules and Regulations (IRR) effective August 7, 2016, aims to fast-track and simplify the land acquisition process. Importantly, RA 10752 also ensures that the rights of property owners and project-affected persons (PAPs) are duly protected. The DPWH Right-of-Way Acquisition Manual (DRAM) provides a clear, uniform, and user-friendly guide for this process.

How Does the Government Acquire ROW?

The government can acquire real property for ROW through several modes:

Negotiated Sale (The Preferred Method):

This is the primary and most favored way to acquire property. The law aims to make the price offer and terms of negotiation more attractive and just for property owners than previous rules.

The compensation price offered by the Implementing Agency (IA) to the property owner is the sum of:

- The current market value of the land.

- The replacement cost of structures and improvements on the land. This is determined based on current market prices for materials, equipment, labor, contractor’s profit, and overhead, without any deduction for depreciation.

- The current market value of crops and trees.

- To determine these values, the IA may engage Government Financial Institutions (GFIs) or Independent Property Appraisers (IPAs) accredited by the Bangko Sentral ng Pilipinas (BSP) or a recognized professional association of appraisers.

- You are given thirty (30) days to decide whether to accept the price offer.

Payments are typically made in two tranches for properties classified as capital assets or ordinary assets:

- First payment: 50% of the land’s negotiated price and 70% of the negotiated price for structures, improvements, crops, and trees, upon the execution of the Deed of Absolute Sale (DAS). This amount is net of any unpaid Real Property Taxes.

- Second and final payment: The remaining 50% for land and 30% for structures, improvements, crops, and trees, is paid upon the transfer of the title to the Republic of the Philippines (if wholly affected) or annotation of the deed on the title (if partially affected), provided the land is completely cleared.

Taxes and Fees for negotiated sales:

- The IA pays the Capital Gains Tax (CGT) (for your account, deducted from the actual consideration/grossed-up value).

- The IA also pays the Documentary Stamp Tax (DST), Transfer Tax, and Registration Fees (funded outside the compensation).

You, as the property owner, are generally responsible for any unpaid Real Property Tax (RPT), which may be remitted by the IA to the LGU concerned and deducted from your compensation.

Expropriation:

This is typically the last resort. The IA may initiate expropriation if:

- You refuse or fail to accept the price offer or fail to submit necessary documents within thirty (30) days.

- Negotiation is not feasible (e.g., owner cannot be found, is unknown, deceased with unsettled estate, or there are conflicting ownership claims).

Upon filing the expropriation complaint, the IA must immediately deposit with the court an amount equivalent to:

- 100% of the value of the land based on the current relevant BIR zonal valuation (issued not more than three years prior). If there’s a difference between BIR zonal value and GFI/IPA market value, the IA adopts the higher of the two.

- The replacement cost of structures and improvements.

- The current market value of crops and trees.

Once this deposit is made, the court immediately issues a Writ of Possession (WOP), allowing the IA to take immediate possession of the property to begin project implementation. The court will then determine the just compensation to be paid to the owner, typically within sixty (60) days from the filing of the expropriation case. If the court’s determined just compensation is higher than the initial deposit, the IA pays the difference. For expropriation, the IA pays the Documentary Stamp Tax (DST), Transfer Tax, and Registration Fees. The owner pays the Capital Gains Tax (CGT) and any unpaid Real Property Tax.

Donation:

- The IA may explore this mode, especially if the owner wishes to contribute to public good.

- A simple and unconditional Deed of Donation is prepared.

- The IA pays the DST, transfer tax, and registration fees, while the donor pays any unpaid real property tax.

Acquisition of Properties under Commonwealth Act (CA) No. 141:

For lands originally granted under the Public Land Act (CA 141).

- If you are the original patent holder or acquired the land through a gratuitous title, the government has a reserved ROW strip (up to 60 meters wide, per PD 635 amending CA 141) for public use. In this case, you are required to execute a “quit claim”. The IA takes possession of the land without compensation for the land itself, but pays for damages to improvements within that strip at their replacement cost. If you refuse to issue a quit claim, the government can still take immediate possession upon due notice, without prejudice to appropriate legal proceedings.

- If you are not the original patent holder and did not acquire the land gratuitously, the IA will follow other modes of acquisition (like negotiated sale or expropriation).

Easement of Right-of-Way:

- This mode is used when the portion of land needed is minimal and the cost of surveying/segregating it would be much higher than its value.

- You retain ownership of the land, but grant the government the right to use the affected portion as ROW.

- You are compensated for the value of that portion of land (based on BIR zonal valuation) plus the replacement cost of any improvements and structures.

Acquisition of Subsurface Properties:

- This applies when infrastructure (like subways or tunnels) needs to be built beneath private lands, typically within a depth of fifty (50) meters from the surface.

- The IA will first negotiate a perpetual easement of ROW for the subterranean portion, with the easement price set at twenty percent (20%) of the land’s market price.

If the negotiation for an easement fails, the IA will offer to acquire the entire affected land, including structures, improvements, crops, and trees.

Protecting Project-Affected Persons (PAPs)

The ROW process also includes provisions for Project-Affected Persons (PAPs), even those who may not have legal title to the land they occupy.

Eligibility for Compensation (Structures/Improvements without Land Rights): Informal settlers who own structures/improvements may be eligible for payment of their replacement cost if they meet all of the following criteria:

- Must be a Filipino citizen.

- Must not own any other real property or housing facility (urban or rural).

- Must not be a professional squatter or a member of a squatting syndicate (as defined in RA 7279, the “Urban Development and Housing Act of 1992”).

- Must not occupy an existing government ROW.

- They must also show proof of ownership of the structure/improvement (e.g., certification from the Barangay).

Relocation Assistance: Informal settler families classified as “underprivileged and homeless citizens” (under RA 7279) who do not qualify for compensation for their structures may still be entitled to relocation. The government, through the Housing and Urban Development Coordinating Council (HUDCC) and the National Housing Authority (NHA), in coordination with Local Government Units (LGUs) and IAs, is mandated to establish and develop resettlement sites, including basic services and community facilities, in anticipation of such relocations.

Who’s Involved in the ROW Process?

Many government entities collaborate to ensure the ROW acquisition process is smooth and fair:

- Department of Public Works and Highways (DPWH): The primary agency responsible for ROW acquisition, including its Unified Project Management Office (UPMO), Public-Private Partnership Service (PPPS), Regional Offices (ROs), District Engineering Offices (DEOs), and Legal Service.

- Department of Transportation (DOTr): The agency responsible for ROW acquisition relative to railway project.

- Office of the Solicitor General (OSG): Handles legal proceedings, especially expropriation cases.

- Bureau of Internal Revenue (BIR): Provides zonal valuations for land and handles tax computations.

- Department of Finance (DOF): Involved in valuation guidelines.

- Housing Agencies (HUDCC, NHA): Coordinate resettlement of informal settlers.

- Department of Environment and Natural Resources (DENR): Involved in land classification, environmental assessments (ECC/CNC), and valuation of trees.

- Local Government Units (LGUs): Assist in relocation, property valuation, tax matters, and enforcement.

- Government Financial Institutions (GFIs) and Independent Property Appraisers (IPAs): Engaged to provide professional property appraisals for compensation.

- Department of Energy (DOE) and National Electrification Administration (NEA): Involved in the relocation of electric cooperative lines.

The entire process, guided by the DPWH ROW Acquisition Manual (DRAM), aims for a quicker, more consistent, transparent, and accountable acquisition process to accelerate socio-economic development across the Philippines.